So what is a vampire attack? And how was SushiSwap able to use a vampire attack to attract over $1B of liquidity in less than a week? You’ll find answers to these questions in this article.

Before we start, if you’re new to DeFi, you may want to read my other articles on liquidity pools and yield farming first as they cover a lot of basic concepts mentioned in this article.

First of all, let’s see how it all started.

SushiSwap

On the 28th of August in the midst of new DeFi projects popping up pretty much every day, a new project called SushiSwap launched. The project quickly gained more and more traction in the DeFi community as it aimed at directly competing with Uniswap by forking the project and siphoning out liquidity with a process later called a vampire attack. The main goal of the project was to create a community-governed automated market maker and fairly distribute its token – SUSHI.

The concept of a vampire attack, although quite simple, is quite ingenious in its nature as it creates very strong incentives for liquidity providers to migrate their liquidity to a new platform.

Let’s see what a vampire attack is all about.

Vampire Attack

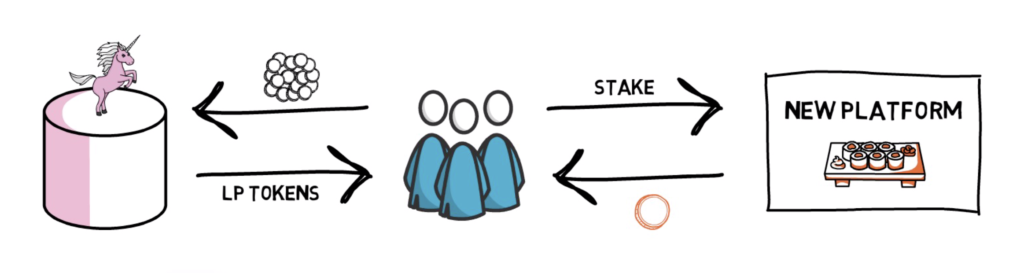

The first step of a vampire attack is to incentivise liquidity providers of another platform to stake their LP tokens, which represent supplied liquidity, to a new platform.

In Sushi’s case, Uniswap’s liquidity providers were incentivised to stake their LP tokens on SushiSwap, so they could receive extra rewards paid in the SUSHI token. SushiSwap started with a quite aggressive emission schedule for the SUSHI token – 1,000 SUSHI per Ethereum block distributed to Uniswap’s liquidity providers across multiple different pools such as SNX-ETH, LEND-ETH, YFI-ETH, LINK-ETH. The idea of involving multiple strong defi communities had already been successfully used by Yam and was reused by SushiSwap.

Once enough liquidity has been attracted to a protocol, the next step of the vampire attack is to migrate staked LP tokens to a new platform. By doing this, a new platform can use the migrated liquidity for their own automated market maker, stealing not only the liquidity but also trading volume and the users of the first platform.

The liquidity is basically sucked out of the first platform and moved into the second platform, hence the name – vampire attack.

When it came to Sushi, this is where Sushi’s MasterChef contract came into play. The MasterChef contract, once triggered, was able to migrate LP tokens from Uniswap to Sushiswap, basically stealing Uniswap’s liquidity. Once liquidity had been migrated it could be instantly used for trading on SushiSwap.

To encourage liquidity providers to participate in the migration, some extra incentives were planned. First of all, the SUSHI liquidity mining program would continue after the migration but with a decreased emission (100 SUSHI per block). On top of that, people who decided to stake their SUSHI tokens instead of selling them would be getting a chunk of trading fees from SushiSwap.

At the end of a successful vampire attack, a new protocol should in theory capture a significant amount of the original project’s liquidity, users and trading volume.

This is basically how the vampire attack was planned. In practice, there were quite a few unforeseen events happening along the way. Let’s see how the SushiSwap launch actually played out.

Chef Nomi

SushiSwap, led by an anonymous creator ChefNomi, started attracting a lot of capital straight after the launch. Liquidity providers, attracted by high APYs of between +200-1000%, started moving more and more of their Uniswap’s LP tokens into SushiSwap. A few hours after launching, SushiSwap was reaching $150M in locked value.

The initial problem of ChefNomi having an admin key to the migration contract was quickly resolved by transferring his admin power to a timelock contract, adding a 48-hour delay to trigger any admin functions.

Although SushiSwap contracts were launched unaudited, the project attracted several audits from a few notable security companies. ChefNomi also decided to start governance of Sushi where SUSHI-ETH LP tokens could be used for voting.

The yield farming craze continued. On the 1st of September, Binance announced the listing of SushiSwap and this resulted in the price of SUSHI going as high as $15. A couple of days later and we were talking about over $1B in locked value. On top of that, a couple of security audits were completed with no critical or high severity issues found.

On the 4th of September, one of the biggest holders of SUSHI SBK, the CEO of FTX and Almeda Research, came out with a future proposal for migrating part of SushiSwap to a new trading platform Serum, built on the Solana blockchain.

In the meantime, the community voted for an early migration from UniSwap to SushiSwap to incentivise liquidity providers with high token distribution for a few extra days after the migration.

The next big unexpected event came from ChefNomi himself who sold his entire SUSHI stake, worth around $14M, for ETH on the 5th of September. This was possible because, although SushiSwap didn’t have a pre-mine or an initial team allocation, it had a dev fund where 10% of all the distributed tokens were allocated and which ChefNomi had access to. After the initial attempt to justify his decision as something good for the project, the community lost trust in ChefNomi who later decided to leave the project.

This led to yet another unexpected event where ChefNomi basically transferred the control of the project to SBF, who decided to be a saviour of Sushi and provide even more incentives to the liquidity providers to stay for the migration with an extra 1 million of SUSHI tokens. On top of that, SBF initialised a transfer of the admin key to a multisig address.

Migration

The migration of liquidity to the SushiSwap platform was carried out by SBF on the 9th of September. From the peak of $1.2B of locked value, around $840M was left for the migration. Everything went smoothly, with all of the remaining liquidity moved to SushiSwap, allowing trading of the tokens supported by the migration.

Because of the early migration, there are still a few more days left with a high emission schedule of 1000 SUSHI per block. This will later drop to 100 per block, or even 50 per block if voted in by the community. It remains to be seen if the liquidity stays on SushiSwap after the high reward period is over.

Return of the Chef

Was that the end of unexpected events? Not really, time for yet another plot twist. On the 11th of August, 2 days after the migration, ChefNomi came back, returning $14M worth of ETH to the dev fund and apologising to the community.

Summary

SushiSwap is clearly one of the most polarising projects in the DeFi space.

I believe that experiments like this are much needed in our nascent industry and they will strengthen the whole ecosystem and make it more resilient in the future.

So what is your opinion on SushiSwap? Do you think it will keep some of the liquidity after the high reward period is over, becoming one of the standard AMMs in the space?

If you enjoyed reading this article you can also check out Finematics on Youtube and Twitter.