So what are the top 3 DeFi-friendly wallets? What features do they support? And what are the pros and cons of using each of them?

Wallets, in essence, allow for sending, receiving and storing cryptocurrency.

They come in many different shapes and forms, but the most popular options are:

- a browser extension

- a hardware wallet

- a mobile app

- or a web wallet

DeFi-friendly wallets facilitate managing your digital assets and interacting with DeFi applications such as decentralized exchanges or lending and borrowing protocols.

Let’s start with a wallet that most DeFi users are very familiar with – Metamask.

Metamask

Metamask is a crypto wallet and a gateway to blockchain apps. It allows users to easily connect to all popular DeFi apps such as Uniswap, Compound, Aave, Maker and Yearn Finance.

Metamask supports ETH and Ethereum based tokens such as ERC20 and ERC721. It is basically a bridge into Ethereum.

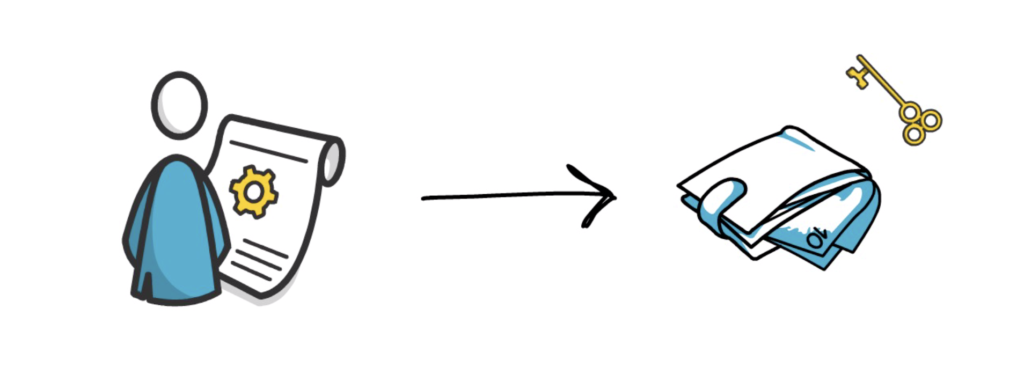

Metamask like all other wallets mentioned in this article is non-custodial. This means that users have complete control and ownership over the assets stored in their wallet.

But like always, with great power comes great responsibility. Users of non-custodial wallets cannot rely on the wallet provider to recover their wallet and instead they have to take wallet recovery into their own hands. This is usually achieved by securing a recovery phrase.

A recovery phrase, also known as a seed phrase, is a set of words that can be used to fully restore a wallet with all of its corresponding private and public keys. This means that losing access to your wallet, together with losing your recovery phrase is equal to losing all of your digital assets stored in that wallet. This is also why everyone who decides to use a non-custodial wallet has to take the security of their recovery phrase seriously.

The basic security measures for your recovery phrase include:

- Write it down offline, for example, on a piece of paper, preferably with multiple copies stored securely in different locations

- Never store any copies of your recovery phrase online, for example, in a Google doc or Apple notes

- Move funds to a new wallet if you have to recover an existing wallet using your recovery phrase

In Metamask, the private keys derived from the recovery phrase are stored in the user’s browser and they are not sent to an external server, for security reasons. The private keys are used to sign transactions in the user’s browser before broadcasting them to the Ethereum network.

Metamask allows for creating multiple accounts where each account has its own pair of private and public keys that can be derived from the recovery phrase.

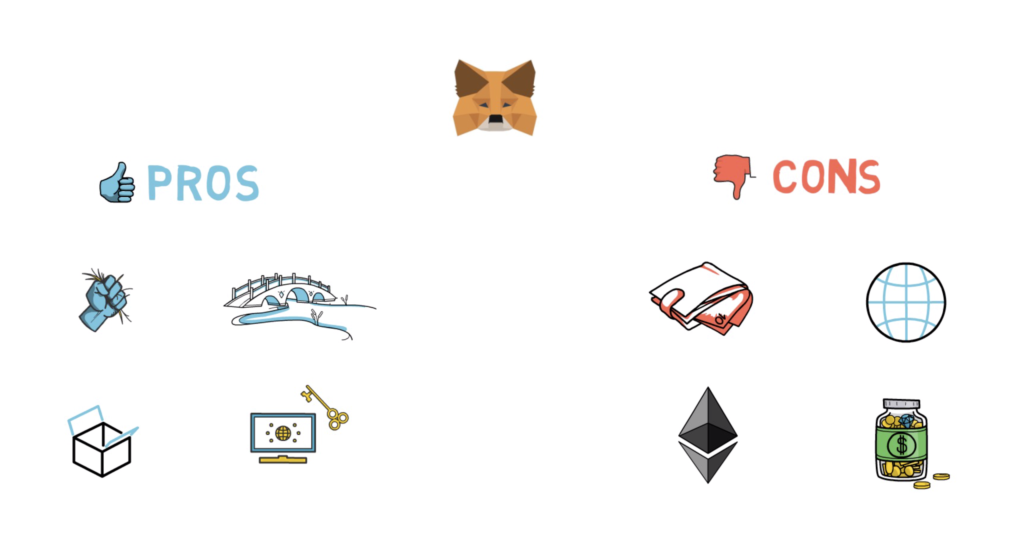

Now, let’s go through the pros and cons of using Metamask.

Pros:

- Non-custodial

- An easy to use bridge into Ethereum and DeFi apps

- Open-source

- Private keys are kept in the user’s browser

Cons

- It is still a “hot” wallet – so the keys are stored on the device that is connected to the Internet which increases the risk

- It only supports Ethereum-based assets – this could be a problem for people who want to keep all of their assets in one place.

With over 1 million users Metamask is usually a go-to wallet for everyone interested in DeFi.

Although Metamask is mostly used as a browser extension, it also offers a mobile app. The users have an option to sync the existing wallet with a mobile app, creating a new wallet or recovering a wallet using a recovery phrase.

Hardware Wallet

Our next DeFi-friendly wallet is a hardware device that most of the cryptocurrency users have already heard of – Ledger.

Ledger allows users to store multiple assets including ETH and ERC20 tokens, Bitcoin, Litecoin or Zcash.

Ledger, similarly to Metamask, requires users to write down their recovery phrase when setting up the device.

With Ledger, user’s private keys are stored offline on a secure hardware device. This provides full isolation between the private keys and online devices such as computers or smartphones that can be more vulnerable to hacks. This makes it a great option for users that have a significant amount of digital assets.

When it comes to DeFi-friendliness, Ledger has recently added a feature that allows for lending coins on Compound directly from the hardware device via the LedgerLive management app. They are also working on adding more DeFi features in the future.

Additionally, Metamask allows users to create a separate account that is connected to a hardware wallet, such as Ledger. The account behaves exactly like any other MetaMask account making navigating across multiple DeFi apps super easy. The main difference is that in order to sign a transaction, the hardware device has to be connected to your machine.

A ledger device is highly recommended to anyone taking the security of their digital assets seriously.

Let’s review the pros and cons of using Ledger:

Pros

- Highest degree of security available for the everyday user

- Supports a wide range of cryptocurrencies

- Integrated with Compound via LedgerLive

Cons

- The inconvenience of using a separate hardware device

- Requires security of the physical device (although each Ledger is also secured by a PIN code)

The most popular model is Ledger Nano S which connects to your computer via USB. Ledger also offers a range of other models including a Bluetooth-based Ledger Nano X.

Ledger is now running a special Black Friday offer with 40% off across all of the devices. You can find a link to the offer here (affiliate).

Mobile Wallet

When it comes to DeFi-friendly wallets that are available on your phone, Argent is one of the best choices.

Argent makes interacting with DeFi easy by directly integrating with multiple different DeFi protocols such as Uniswap, Aave, Compound or Set Protocol.

Argent, similarly to the other already mentioned wallets, is non-custodial. When a new wallet is created, Argent creates a smart contract on Ethereum that is controlled by the user of the wallet, so Argent doesn’t have any control over that smart contract at any point. This allows for enabling extra features that wouldn’t be possible to achieve just with a simple Ethereum address.

When it comes to security, Argent uses a different recovery model. Instead of writing down a recovery phrase, users can set up social recovery by choosing “Guardians”. Guardians can be your trusted friends or family members, but also other devices such as hardware wallets, MetaMask or third party services.

In order to recover a wallet, the majority of Guardians have to provide an approval. If the number of Guardians is even, 50% is enough to proceed with the recovery.

On top of this, Argent provides an option to set daily transfer limits and even the ability to temporarily freeze your wallet, just like how we can freeze a credit card.

Time for the pros and cons of using Argent:

Pros:

- Non-custodial

- Doesn’t require a recovery phrase

- Integrated with the most popular DeFi protocols

- Daily limits and locking option

Cons:

- Requires a good understanding of the social recovery model

- Still a limited number of DeFi protocols available (cannot just use a new one)

- Still not as secure as a hardware wallet

You can get your Argent wallet here.

DeFi Dashboards

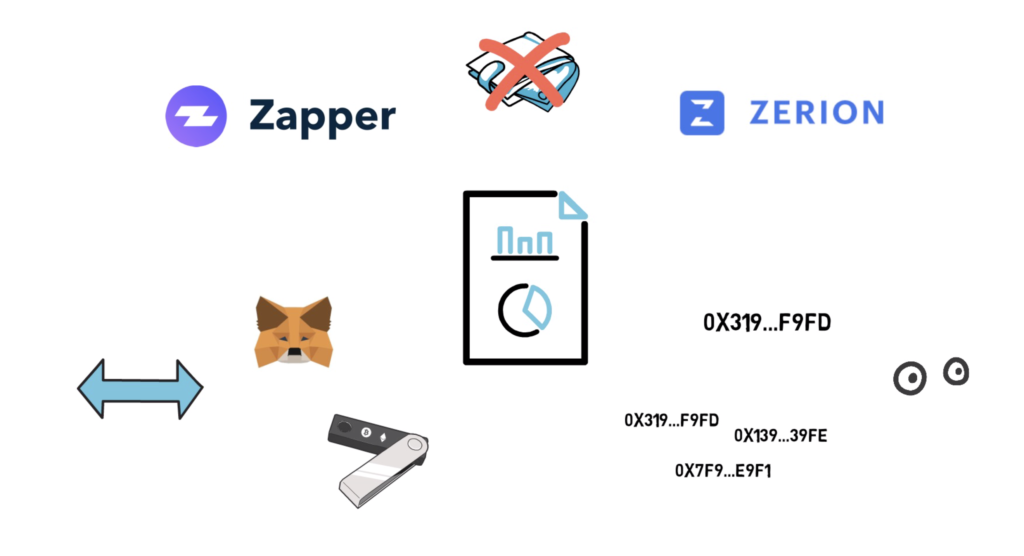

Although they are not strictly wallets it’s also worth mentioning two apps that make managing a DeFi portfolio easy – Zapper and Zerion.

Both apps allow users to see their consolidated portfolio in one place. A user can either connect a wallet, such as Metamask or Ledger, to be able to invest or transfer their assets or they can provide an address/set of addresses to see a portfolio in a view-only mode.

So what is your favourite DeFi-friendly wallet? Do you think we missed some good ones?

Also, don’t forget about our 40% Ledger discount here.

If you enjoyed reading this article you can also check out Finematics on Youtube and Twitter.